If you want to attract top employees and keep them happy, you need an enticing benefits package. You also need to manage benefit costs to ensure they’re driving the results you’re looking for in your hiring and talent management efforts.

Since some job benefits are required by law, making sure your benefits meet applicable requirements and are properly managed is another key human resource (HR) task for small businesses.

Mandatory benefits small businesses must offer employees

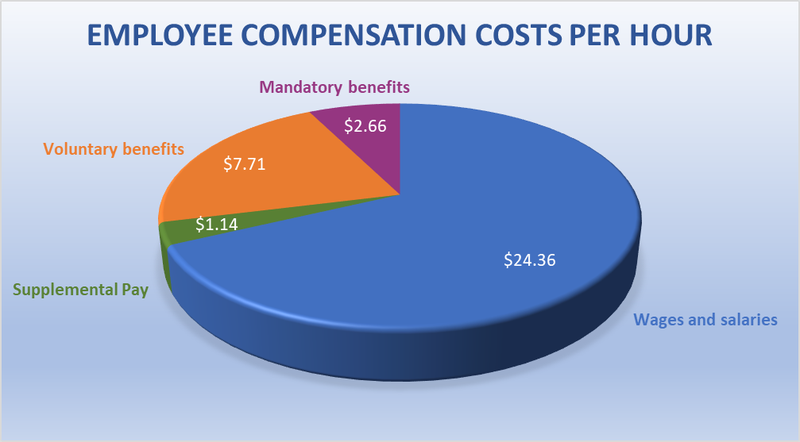

The U.S. Bureau of Labor Statistics (BLS) reports that on average, employee compensation and benefits cost employers $34.73 per hour worked, with wages of $24.36 and benefit costs of $10.37.

Legally required benefits make up just $2.66 per hour, or 7.7% of those costs. Supplemental pay such as bonuses and overtime cost an additional $1.14 per hour.

The following employee benefits are required for all employers, no matter their size.

1. Social Security and Medicare

For every employee, businesses must withhold Federal Insurance Contributions Act (FICA) taxes of 1.45% for Medicare and 6.2% on the first $137,700 of earnings for Social Security. Employers must also contribute an equal share into the funds.

On average, these taxes cost employers $2.05 per hour worked, or 5.9% of compensation.

2. Unemployment insurance (UI)

Employers must also pay Federal Unemployment Tax Act (FUTA) taxes and state unemployment taxes. In Alaska, New Jersey, and Pennsylvania, employers must also withhold employee taxes for UI. All told, UI taxes cost employers $0.17 per employee hour.

3. Workers’ compensation

While generally not required by federal law, every state has a workers’ compensation fund to provide care for workers injured on the job. The funds are administered by state labour departments. On average, workers’ compensation costs businesses $0.45 per hour or 1.3% of compensation.

4. Overtime pay

Under the FLSA, you must provide employees who earn less than $684 per week or $35,568 per year with overtime pay for hours worked beyond 40 in a workweek. The minimum rate for overtime is one-and-a-half times the employee’s usual hourly wage.

The FLSA does not require you to pay a premium for night or weekend work.

5. Jury duty leave

All employers must provide unpaid leave for employees called to jury duty. In some states, jury duty leave must be paid.

6. Coronavirus leave

At this writing, the Families First Coronavirus Response Act (FFCRA) requires certain employers to provide up to 80 hours of sick leave for employees who are stricken by COVID-19, under quarantine, caring for someone under quarantine, or caring for a child during COVID-19-related school closure.

The law further provides up to 10 weeks of paid family and medical leave for childcare needs related to COVID-19.

Small businesses may request an exemption from provisions of the FFCRA if meeting them would pose a substantial threat to their operations.